Wondering how America pays for college? You’re not alone. Millions of students and their families are trying to figure out how to foot the bill for postsecondary education. The good news is that there are plenty of options, including grants, scholarships, work-study programs, and loans. The bad news is that there’s no one easy answer. Every student’s situation is different, so it’s important to do your research and explore all your options. Keep reading to learn more about how those who have no income saved, or are too uncomfortable with asking their parents for help pay for their education!

How America pays for College/Uni

USNETLOAN has done huge research to find out how students actually pay for college in the US. Our specialists asked more than a thousand students from different universities all around the USA:

- Temple University

- Carnegie Mellon University

- College of Lake Country

- Lourdes University

- Massachusetts Institute of Technology

- Virginia Tech University

- Emerson College

- USC University of Southern California

- Oregon State University

- Washington State University

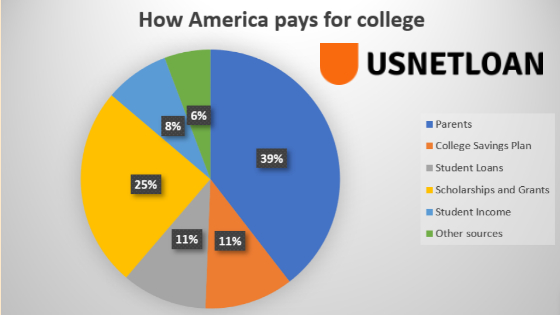

According to the poll results, there’re six major ways used by students to cover educational costs:

- Scholarships and grants

- Parents and relatives

- Savings

- Extra income

- Loans

- Other sources

These ways with the percentage of people that use them are demonstrated in the diagram below:

As we see from the diagram, the prevailing majority of Americans ask their parents or maybe other relatives for financial aid to pay for their education. It’s probably the right way, as you aren’t charged high interest rates as it is in the case of loans. However, one can be embarrassed to ask for help even from the closest people. For some students, it’s easier to find a job or apply for a loan to avoid this awkwardness.

How to pay for college with no money

It’s no secret that college is expensive. In fact, the average student graduates with more than $37,000 in student loan debt. But what if you don’t have any money saved up to pay for school? Don’t worry – there are several ways to get help paying for college, even if you don’t have any savings. They are as follows:

- Apply for a grant or scholarship

- Apply for federal student financial aid

- Find a side gig to earn extra cash

- Study how to plan your budget and cut down on expenses

- Consider applying for a loan

- Look for tuition-free colleges

- Enter a community college

- Take advantage of student loan relief programs

- Ask for help

Weigh all the pros and cons of each financing method and choose the best to suit your needs.

How to pay for college without parents help

College is an expensive venture, but it doesn’t have to cost you your life. With some creative thinking and determination, there are ways for students without money on their own parents’ profiles or who live at home with family members while pursuing higher education degrees!

The first step in getting financial aid isn’t always obvious: Apply. As we’ve already shown in the diagram before, and in the list of ways available for those with no money saved, there still exist other alternatives to pay for college. Student loans, extra jobs, savings plan can become a good solution.

Jobs that help pay for college / How to make money while in college

Having studied the most frequent jobs students take up to pay for their studies, we’ve determined the three main groups of employment:

| On-campus | Off-campus jobs | Freelancing / Entrepreneur jobs |

|---|---|---|

|

|

|

How do scholarships work?

There are so many scholarship opportunities available to college applicants that it’s hard not to find at least one! The four major sources of scholarships and grants include federal, state-level programs as well scholarships from schools. Federal aid accounts for 47% of total grant money awarded; however, this includes loans too which means you’ll have interest charges on your balance until they’re paid off with additional monthly payments if repayment doesn’t happen automatically after graduation (which could also raise some red flags). State funding makes up 8 percent while private organizations provide an extra 10% of funding.

Scholarships are available for students with a wide range of academic achievements. You may be eligible if you meet any number or combination of criteria, including need and/or membership in an organization to how well your abilities match up against certain fields being explored by potential scholarship holders!

If you live or go to school within a certain state, there may even be an award specifically designed just for your town!

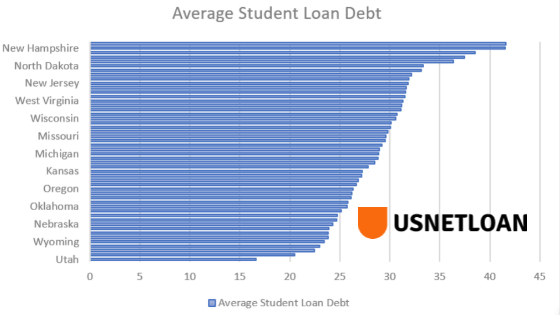

Average student debt by state

According to Peterson’s financial aid dataset, the average student loan debt is the following in each state:

| State | Average student loan debt | State | Average student loan debt | State | Average student loan debt |

|---|---|---|---|---|---|

| Alabama | $31,174 | Delaware | $37,447 | Iowa | $28,466 |

| Alaska | $27,852 | Florida | $22,953 | Kansas | $27,216 |

| Arizona | $24,709 | Georgia | $29,783 | Kentucky | $29,523 |

| Arkansas | $23,798 | Hawaii | $23,914 | Louisiana | $23,855 |

| California | $25,112 | Idaho | $25,771 | Maine | $36,339 |

| Colorado | $26,111 | Illinois | $28,960 | Maryland | $32,165 |

| Connecticut | $41,579 | Indiana | $26,641 | Massachusetts | $31,549 |

| Michigan | $28,895 | Nebraska | $24,266 | New York | $29,209 |

| Minnesota | $33,168 | Nevada | $22,418 | North Carolina | $26,866 |

| Mississippi | $31,485 | New Hampshire | $41,511 | North Dakota | $33,318 |

| Missouri | $29,613 | New Jersey | $31,818 | Ohio | $30,047 |

| Montana | $27,154 | New Mexico | $20,497 | Oklahoma | $25,737 |

| Oregon | $26,328 | Tennessee | $28,821 | Virginia | $30,688 |

| Pennsylvania | $38,521 | Texas | $24,655 | Washington | $26,207 |

| South Carolina | $31,902 | Utah | $16,633 | Washington D.C. | $30,118 |

| South Dakota | $31,129 | Vermont | $31,619 | West Virginia | $31,317 |

| Wisconsin | $30,600 | Wisconsin | $30,600 |

The states with the highest student loan debt are shown in the chart below. They are NH, ND, NJ, WV, WI, and others as stated below:

How Your State Could Help You Pay for College

You should start thinking and planning college fees much earlier than it’s high time to enter the institution. Every state offers several plans to help applicants save enough money to pay tuition.

When you have a child, there are so many things that come into play. One of the most important decisions for parents and students alike: what type of education plan will they use? An investment in their future with either an Education Savings Plan or Prepaid Tuition Plans can pay off big time by helping fund tuition at any accredited institution across America!

As soon as you’ve chosen the college to enter, find out what 529 plan they offer in order to take the best advantage of your tax savings in the future. Among the US college payment plans we should mention those with the most beneficial conditions to help you pay for college:

- Michigan Education Savings Program

- My529

- Oregon College Savings Plan

- Private College 529 Plan

- ScholarShare 529 College Savings Plan

- Bright Start College Savings Program

- Invest529

Student Loan Forgiveness by state

The student loan forgiveness programs are a way for states to help students afford college and graduate with less stress. Unfortunately, more than half the country has stopped offering this incentive which means that those who want it may have trouble finding an affordable school in their area- especially if they’re not elsavid having tuition covered by other sources like scholarships or grants (or even jobs).

Check our complete list of Student Loan Forgiveness programs offered by state:

| State | Number of programs available | Student Loan Forgiveness program |

|---|---|---|

| Alabama | 1 | Public Student Loan Forgiveness |

| Alaska | 1 | SHARP II – Health Care Professions Loan Repayment and Incentive Program |

| Arizona | 3 | Primary Care Provider Loan Repayment Program (PCPLRP) and Rural Private Primary Care Provider Loan Repayment Program (RPPCPLRP) Math, Science, Special Education Teacher Loan Forgiveness Joyce Holsey’s ALL (Arizona’s Legal Legacy) Loan Repayment Assistance Program

|

| Arkansas | 2 | State Teacher Education Program (STEP) Out-Of-State Veterinary Medical Education Loan Repayment Program |

| California | 3 | Steven M. Thompson Physician Corps Loan Repayment California State Loan Repayment Program CDA Foundation Student Loan Repayment Grant |

| Colorado | 3 | Colorado Health Service Corps University of Denver Sturm College of Law Loan Repayment Assistance Program Colorado’s Law Loan Repayment Assistance Program |

| Connecticut | 1 | Minority Teacher Incentive Program

|

| Delaware | 1 | Delaware State Loan Repayment Program |

| Florida | 2 | Nursing Student Loan Forgiveness Program Loan Repayment Assistance Programs for Lawyers |

| Georgia | 1 | Physicians for Rural Areas Assistance Program |

| Hawaii | 1 | Hawaii State Loan Repayment Program |

| Idaho | 1 | Idaho State Loan Repayment Program |

| Illinois | 4 | Illinois Teachers Loan Repayment Program John R. Justice Student Loan Repayment Program Nurse Educator Loan Repayment Program Veterans’ Home Nurse Loan Repayment Program |

| Indiana | 1 | Justice Richard M. Givan Loan Repayment Assistance Program |

| Iowa | 5 | Teach Iowa Scholars Iowa Registered Nurse & Nurse Educator Loan Forgiveness Program Rural Iowa Primary Loan Repayment Program Rural Iowa RN and PA Loan Repayment Program Health Professional Recruitment Program

|

| Kansas | 3 | Rural Opportunity Zones Student Loan Repayment Program Kansas State Loan Repayment Program Kansas Bridging Plan |

| Kentucky | 1 | Kentucky State Loan Repayment Program |

| Louisiana | 3 | Louisiana State Loan Repayment Program John R. Justice Student Loan Repayment Program Louisiana Bar Foundation Loan Repayment Assistance Program |

| Maine | 4 | Educators for Maine Maine Health Professions Loan Program Forgiveness Maine Veterinary Medicine Loan Program Forgiveness Maine Dental Education Loan Repayment Program |

| Maryland | 3 | Maryland SmartBuy Home Buyer Assistance & Forgiveness Program Janet L. Hoffman Loan Assistance Repayment Program Maryland Dent-Care Loan Assistance Repayment Program |

| Massachusetts | 1 | Massachusetts Loan Repayment Program for Health Professionals |

| Minnesota | 10 | Minnesota Dentist Loan Forgiveness Program Minnesota Long Term Care Nurse Loan Forgiveness Program Minnesota Nurse Faculty Loan Forgiveness Program Minnesota Rural Advanced Practice Provider Loan Forgiveness Program Minnesota Rural Dental Therapist/Advanced Dental Therapist Loan Forgiveness Guidelines Minnesota Rural Mental Health Professional Loan Forgiveness Minnesota Rural Pharmacist Loan Forgiveness Program Minnesota Rural Physician Loan Forgiveness Program Minnesota Rural Public Health Nurse Loan Forgiveness Program Minnesota State Loan Repayment Program (SLRP) Minnesota Urban Advanced Practice Provider Loan Forgiveness Program Minnesota Urban Mental Health Professional Loan Forgiveness Program Minnesota Urban Physician Loan Forgiveness Program |

| Michigan | 2 | Michigan State Loan Repayment Program (MSLRP)

|

| Mississippi | 1 | Mississippi Teacher Loan Repayment (MTLR) Program

|

| Missouri | 3 | Health Professional Student Loan Repayment Program Health Professional Nursing Student Loans PRIMO Student Loan Program |

| Montana | 1 | Montana Rural Physician Incentive Program (MRPIP) |

| Nebraska | 1 | Nebraska Student Loan Repayment Program |

| Nevada | 1 | NURSE Corps Loan Repayment Program |

| New Hampshire | 1 | New Hampshire State Loan Repayment Program (SLRP) |

| New Jersey | 1 | Nursing Faculty Loan Redemption Program |

| New Mexico | 2 | New Mexico Health Professional Loan Repayment Program (HPLRP) New Mexico Public Service Law Loan Repayment Assistance Program (LRAP) |

| New York | 9 | Albany Law School Loan Repayment Assistance Program (LRAP) New York State Teacher Loan Forgiveness Program New York State Young Farmers Loan Forgiveness Incentive Program NYS Child Welfare Worker Loan Forgiveness Incentive Program NYS District Attorney and Indigent Legal Services Attorney Loan Forgiveness (DALF) Program NYS Get on Your Feet Loan Forgiveness Program NYS Licensed Social Worker Loan Forgiveness (LSWLF) Program NYS Nursing Faculty Loan Forgiveness (NFLF) Incentive Program Physician Loan Repayment Program Regents Physician Loan Forgiveness (RPLF) |

| North Carolina | 3 | Forgivable Education Loans for Service NC LEAF Loan Assistance Repayment Program North Carolina State Loan Repayment Program (SLRP) |

| Ohio | 2 | Ohio Dentist Loan Repayment Program |

| Oklahoma | 3 | Physician/Community Match Program Oklahoma Dental Loan Repayment Program (ODLRP) Oklahoma Physician Assistant Loan Repayment Program Oklahoma Physician Loan Repayment Program |

| Oregon | 2 | Health Care Provider Incentive Program OSB Loan Repayment Assistance Program (LRAP) |

| Pennsylvania | 2 | PA IOLTA Loan Repayment Assistance Program (LRAP) Pennsylvania Primary Care Loan Repayment Program (LRP) |

| Rhode Island | 3 | Health Professionals Loan Repayment Program Nursing Reward Program Wavemaker Fellowship |

| South Carolina | 1 | Public Interest Law Loan Forgiveness Fund (PILLFF) |

| South Dakota | 1 | Dentist Loan Repayment for Service Program |

| Tennessee | 1 | Graduate Nursing Loan Forgiveness Program Minority Teaching Fellows Program Tennessee Math and Science Teacher Loan Forgiveness Program |

| Texas | 9 | Attorney Student Loan Repayment Program (ASLRP) Nursing Faculty Loan Repayment Assistance Program Physician Education Loan Repayment Program (PELRP) Teach for Texas Loan Repayment Assistance Program (TFTLRAP) Texas Student Loan Repayment Assistance Program (SLRAP) |

| Vermont | 5 | Dental Educational Loan Repayment Program Nurses Educational Loan Repayment Program Physicians, Nurse Practitioners, and Physician Assistants Educational Loan Repayment Program Vermont Bar Foundation’s Statewide Loan Repayment Assistance Program (VBF-LRAP) |

| Virginia | 3 | Herbert S. Garten Loan Repayment Assistance Program (LRAP) Virginia Loan Forgiveness Program (VLFP) Virginia State Loan Repayment Program (VA-SLRP) |

| Washington | 1 | Washington Health Professional Loan Repayment Program |

| West Virginia | 1 | West Virginia State Loan Repayment Program (SLRP) |

| Wisconsin | 1 | Health Professions Loan Assistance Program (HPLAP) |

| Wyoming | 1 | Veterinary Medicine Loan Repayment Program |

Which loans you’d better avoid

There’s no doubt that student loans can be a touchy subject. When you hear the number of debt students accumulate, it might seem like a crisis. It can affect your future credit history and financial wellbeing.

It’s a terrible responsibility to have large amounts of outstanding debt from things such as student loans, credit cards, and car titles. It may lead to your future borrowing of too expensive short-term loans at times when you come across urgent expenses or other emergencies for the reason of paying off your student loan. So, think carefully first before making the final decision on whether your college education is worth all these risks.

Which loans could really help

Loans are a great way to get the money you need for college. However, if your interest rates are too high then it may end up costing more in the long run due on payback charges when compared with other types of loans such as subsidized ones which come at little cost from federal governments.

Home equity loans, personal loans, and tuition payment plans could all help you pay for college.

With this type, there is no risk involved since they will cover virtually all fees associated with getting an undergraduate degree even including any private scholarships offered by schools themselves! The best alternatives to borrowing money to pay for college are:

- Federal Perkins Loans

- Federal Direct Subsidized Loans

- Federal Direct Unsubsidized Loans

- Federal Direct Plus Loans

- Private (Alternative) and State Loans

- Personal Loans up to $35,000 can also be used to cover the cost of education and can be rather convenient due to lower interest rates and longer repayment terms

It’s never too late to get started on your college education. In fact, there are a number of ways that you can pay for it without having to take out any loans or spend any money upfront! You may be surprised at how easy and affordable some of these options actually are. If you’re looking for the best way to fund your degree, keep reading this blog post. We’ll show you all the different strategies so that you can find one that fits both your needs and budget perfectly.

Personal Loan Calculator

Every Payment (Installment) = $522 per month for 0.17 year(s) at 35% APR

* It’s the amount of money you’ll need to pay every month (or other agreed period) according to your repayment plan.

Total Paid After 2 Payments = $1,044

Total Interest Paid* = $44

* The total amount of interest over all the period of the loan.