Before applying for a loan, it is recommended that you study the various offers, choose the most profitable one, pay attention to the lender’s interest rates and make sure you are eligible to apply. Also pay attention to the laws of your state!

Guaranteed Payday Loan no matter what – is it possible?

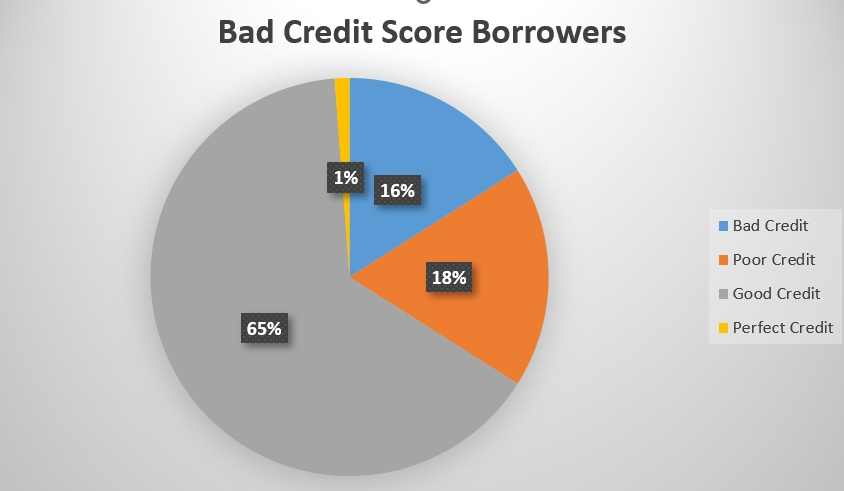

More and more borrowers with bad or poor credit are looking for a type of financing that will help them get guaranteed approval to cope with any financial need. Many of them use a Payday Loan as an opportunity to borrow money.

However, it should be understood that although Payday Loans have a high chance of being approved, they are not guaranteed as you still need to meet certain eligibility criteria. Learn how a Payday Loan works, how to apply, what are the eligibility criteria and how to increase your chances of getting a loan.

Payday Loans and Bad Credit is it OK?

A Payday Loan is a simple and secure type of financing so that borrowers with any type of credit can apply and receive financing to cover emergency needs. This loan is unsecured, so no collateral is required. It is also worth remembering that Bad Credit Payday Loan is only a short-term solution to your problems and the debt must be paid on the day of your next paycheck (often within 2 weeks). If you have bad or poor credit history, you are still eligible to apply and receive funding.

What are my chances of getting a Payday Loan?

Although you may not be able to find a guaranteed loan to cover your needs, Payday Loan is still the right option for you. More than 80% of applications for Payday Loans are approved, so your chances of getting funding are high.

Can I get a Payday Loan with no credit check?

Most payday lenders do not ask for a traditional credit check when they approve your application. For such loans, the most important factor in determining whether you get a loan is a regular monthly source of income. If you can prove that you are getting paid, then you will most likely be able to get a loan even without a credit check.

Some payday lenders request a soft credit check. However, do not worry, as it will not affect your credit history.

Can I still borrow money if my credit is bad?

Only 1,2% of Americans can boast of perfect credit, and all the others have to look for financing available for bad or poor scores.

You won’t necessarily be prohibited from borrowing money if you have a bad credit history, but it might be more challenging for you to get the best rates and terms on credit. It’s a good thing that some lenders are open to working with consumers that have less than ideal credit histories.

While having a history of defaults or even bankruptcy may worry lenders, what frequently matters is whether or not your current situation will allow you to adequately repay what you owe. Lenders will still consider your credit history in their judgments, but it won’t be the sole one and it won’t immediately bar you from getting a loan.

Can I get a bad credit Payday Loan guaranteed approval?

If you are looking for a Guaranteed Payday Loan no matter what, then unfortunately you will not be able to get such a loan offer. No lender provides 100% guaranteed loans as this is too risky. All loans are based on the lending criteria that must be met in order for your application to be approved. Based on these requirements, lenders examine your details and decide whether to provide you with a loan. Payday lenders have a minimum number of requirements to meet, so a loan is easy enough to get. However, these lenders still do not offer guaranteed approval.

If you see a Guaranteed Payday Loan on the Internet, be careful as you are most likely dealing with scammers.

How can I use a Guaranteed Payday Loan No Credit Check?

Often, payday lenders do not have any restrictions on how you can use the money received, so you can spend the financing for any need.

However, the Guaranteed Approval Payday Loan is a rather expensive loan, so it is recommended to use it only in an emergency. Borrowers often apply to cover expenses such as medical treatment, car repairs, emergency purchases, utility bills, and more.

How does the Guaranteed Payday Loan work?

Now the Payday Loan is as simple as possible. Just imagine, you no longer have to go to the lender’s store, wait for hours for approval and fill out a large amount of paperwork. The whole process from filling out a simple online form to receiving funding is available online! Thus, all you need to do is choose a lender, apply and receive financing directly into your bank account.

How do I apply for the Guaranteed Cash Advance?

You need to follow 4 simple steps:

- Choosing a lender. Browse through various loan offers and choose the one that has the most favorable credit terms.

- Online application. Visit the lender’s website and fill out a simple online form. You must provide name, address, income information, contact details, and more.

- Approval. Applications are approved almost instantly, so the lender will contact you to discuss the terms of the loan on the same day.

- Financing. By signing a loan agreement, you can receive money directly to your bank account the very next business day.

How can I increase my chances of getting the Online Payday Loan guaranteed approval?

Before applying for funding, you must carefully review the eligibility criteria to ensure that you are eligible. It is also very important to pay attention to state laws and make sure you can apply.

Also you can provide all the necessary documents and confirm that you are receiving regular monthly payments.

What are the eligibility criteria for getting a Bad Credit Payday Loan?

As you know, each lender has its own eligibility criteria that must be met, and the payday lender is no exception. Explore the main ones:

- Be a US citizen or official resident

- Be at least 18 years old

- Have a regular monthly source of income and

- Have an active bank account

- Provide government issued ID

- Provide social security number

- Provide contact details such as phone and email

Please be aware that eligibility criteria may vary depending on state laws and the lender chosen.

Costs of guaranteed payday loans online

You will pay costs to obtain a payday loan. Your next paycheck will be reduced to reflect these fees, so you will receive less money in the future. Some people who start taking out payday loans to help them get by risk getting stuck in a cycle of borrowing that is challenging to break.

You may be charged $15 for every $100 borrowed by a payday lender. For instance, if you take out a payday loan for $500, the interest and fees could total up to $75.

Payday loan fees

In accordance with the legislation, most payday loan fees are capped. Consult a free attorney for help on how to get your money back if you are charged more than the maximum rate.

You may be assessed these fees by payday lenders:

| Establishment Fee | 20% of the borrowed amount is the maximum charge. |

| Monthly Fee | 4% of the total amount borrowed is the maximum monthly charge. |

| Default Fee | If you don’t make a repayment by the due date specified in the contract, you could be charged up to twice the amount you borrowed. |

How to pay back your loan?

If you need help repaying your payday loans because you are having trouble making your payments, you can contact your lender in order to receive an adequate assistance.

Licensed payday lenders are required by law to make prudent loans. This implies that if they believe you won’t be able to repay the debt or that it could put you through a great deal of difficulty, they cannot grant you a loan. Get free legal counsel if you believe the lender did not lend responsibly.

Rights and obligations

Payday lenders are regulated, therefore any business providing payday loans needs to have a license and abide by the rules established by the provincial government. Using this licensing lookup tool, you may determine whether a business has a license. The license must be visible wherever the company provides payday loans, both online and in-person.

A borrower of a payday loan is entitled to:

- Review the credit agreement for the payday loan to see what the costs are in plain, straightforward English.

- Repay the payday loan early, within two full business days of receiving it, and without penalty.

- You can pay back any amount of the payday loan before it’s due without incurring penalties.

- If this is the borrower’s third payday loan from the lender in the previous two months, repay the amount over the course of two or three pay weeks.

Payday Loan Calculator

$500 Your loan + $79 Your fee = $579 Total Cost*

* Total Cost - The sum of money you are to pay off within the term you’ve chosen if you borrow the stated above amount for the average (or required by your lender) APR.