Online car title loans are becoming more and more popular these days. These loans have your car, truck, or other vehicle as collateral. They are usually between 25 and 50 percent of the value of the car.

To get a car title loan, you must give the lender the title of your car. Generally, you must own the car freely and without a lien, but some lenders will agree to take title if you have paid off most of the loan.

The average monthly finance charge on title loans is usually 25%, which equates to an APR of about 300%. In the case of a rollover, the cost goes up. If you cannot repay your title loan on the due date, the lender may offer to roll it over to a new loan, but rolling over the loan will increase the interest and fees on the amount you owe.

Virginia Title Loans 2022 Popularity Peak

In Virginia, title loans are regulated by strict rules setting maximum loan amounts, terms, and interest rates. Virginia’s Fair Lending Act, which took effect Jan. 1, 2021, has received support from a variety of stakeholders, including consumer advocates, community organizations, religious leaders, low-cost installment lenders, and the state attorney general. The cost of small-dollar loans in Virginia is now about three times lower than it was before the reform. The law closes loopholes, bans balloon payments, and modernizes laws to ensure broad access to credit under uniform rules that guarantee affordable installment payments for borrowers and a level playing field for lenders.

Here are some features of lending in Virginia that may be helpful to those planning to take out a car title loan online:

- The term of the loan should not be shorter than 120 days and should not exceed 12 months. But Virginia not only insists on giving borrowers a title loan of four months to repay the loan, but also that repayments must be in more or less equal monthly installments of both principal and interest.

- The interest rate in Virginia is capped at 22 percent per month for loans up to $700. Loans between $701 and $1,400 have a rate capped at 18 percent per month; loans over $1,400 have a rate capped at 15 percent per month.

- While some states allow title lenders to sell your car without notifying you when the sale will take place, in Virginia title loan providers must notify you in writing at least 15 days in advance of the sale. The notice has to include the earliest date and time that your car may be sold, as well as a detailed statement of how much you owe on the loan.

- If you have a title loan in Virginia and the lender is not following the law, or if you have any complaints about a title lender, you can direct your complaints to the Bureau of Financial Institutions. In many cases, you can recover actual and punitive damages because Virginia takes violations of the law seriously.

Not surprisingly, the demand for title loans in Virginia has grown steadily in recent years. An easy online title loan in Virginia is a reality!

Highest gas prices in Virginia in July 2022

Gas prices continue to increase across the country, with Virginia residents paying an average of about $4.80 per gallon.

The problem, caused by supply chain disruptions and increased demand as the world recovers from the COVID-19 pandemic, has been exacerbated by Russia’s invasion of Ukraine, causing prices to rise even higher. After stay-at-home orders were lifted and people started to travel more, demand exceeded supply, and all this was exacerbated when refineries closed plants and began laying off employees.

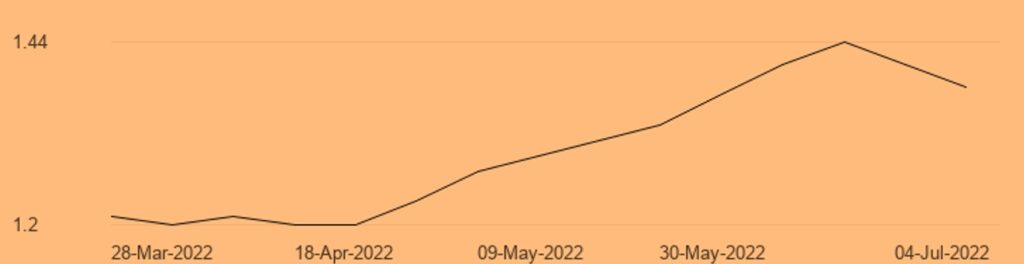

Virginia gas prices from March 28-2022 to July 04-2022.

1.30 U.S. – the average value for Virginia during this period. Dollar with a minimum of 1.20 U.S. on 04-Apr-2022 and a maximum of 1.44 U.S. on 20-Jun-2022. 2.01 U.S. is the global average price of gasoline over this period.

Gas prices are rising not only in the U.S., but throughout Europe as inflation affects the cost of other basic needs, including food and housing.

President Joe Biden, in his executive order, announced the use of one million barrels a day from the Strategic Petroleum Reserve, thereby attempting to ease the suffering of consumers.

Payday Loan Calculator

$500 Your loan + $79 Your fee = $579 Total Cost*

* Total Cost - The sum of money you are to pay off within the term you’ve chosen if you borrow the stated above amount for the average (or required by your lender) APR.