No credit check car title loans are collateral based, that’s why safe for the lender and easy to get for the borrower. Your vehicle title is used to secure the loan with no credit inquiry, and no inspection. No matter what your FICO score is, you are guaranteed to get instant title loan approval from direct lender in case you meet their basic requirements.

As a result, Title loans without credit checks provide you with a quick financial assistance when you need urgent cash for bad credit.

However, be careful choosing the lender. Many of those offering money with no credit history check, are either scammers or charge excessive interest rates. Apply only to a legitimate lending company with full disclosure of lending rates and terms, as well as their privacy policy online.

Is it Possible to Find No Credit Check Title Loans?

Your credit score is supposed to show your financial situation, behaviour, loan and debt types as well as the ways you manage them. It’s necessary for the lender to make sure you are able to handle the loan you apply for. The approval is typically based on this criterion.

However, Title Loan lenders may avoid hard inquiries as they have your car title as collateral to make them feel safe in concern to your loan repayment. They also take into account your income, your vehicle value, etc. to make a decision on your creditworthiness and offer you a car title loan with no credit check.

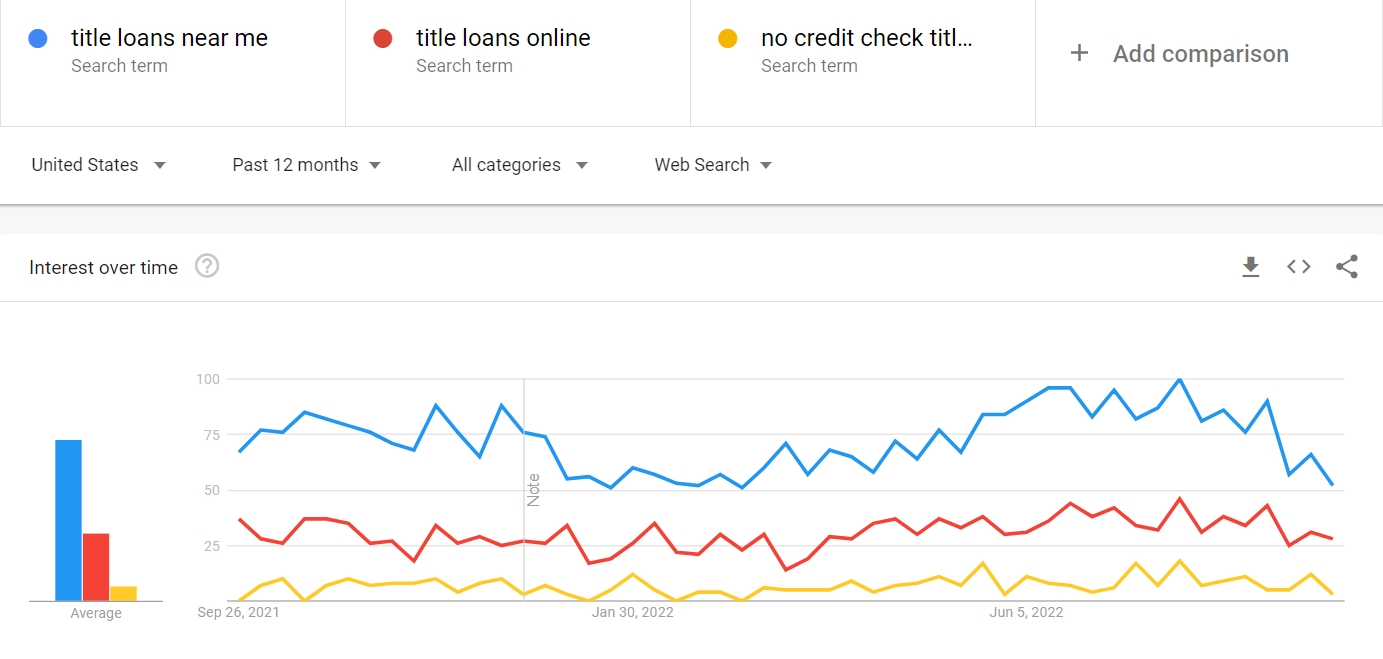

Let’s compare the google trends for 3 top queries of “Title Loans Near Me”, “Title Loans Online”, and “No Credt Check Title Loans” and we’ll see that they develop in more or less similar pace with regular boosts and drops in popularity.

What are the requirements?

No matter what state you live in, there are always going to be some requirements that you need to meet in order to get an online title loan with no credit check.

- For example, if you are using your car as collateral, then you will need to get a receipt from the lender that entitles them to your vehicle.

- You will also need to have the original title of the collateral so that the lender can insure it.

- Some other things that you might need include a valid government-issued ID, proof of residency, proof of monthly income, and pictures of your car or vehicle.

How Title Loan No Credit Check Online Approval Works

Car title loans are a quick and easy way to get emergency funding. The approval process is simple and can be completed in three steps. Here is how it works:

- Start by submitting an inquiry online. You will need to provide some basic information about yourself and your car.

- Once your inquiry is received, a title loan agent will review your information and request additional documentation, if needed. Generally, you will need to provide proof of identification, proof of address, proof of income, and photos of your car.

- Once all of your documents are verified, you will be fully approved for the loan and can receive the emergency funding you need!

Documents required for a Title Loan Approved with No Credit Check

- The car title in your name.

- A government-issued photo or your driver’s license, state ID, or U.S. passport as a proof of identification.

- Some proof of your current U.S. address.

- Proof of your ability to repay the loan on time – paycheck stubs, bank statements, tax returns, etc.

- Pictures of your vehicle.

- References from your employer.

What Are the Advantages of No Credit Check Car Title Loans?

- No-Stress Qualification. You know how stressful it can be if you’ve ever taken time from work to spend a few hours in the loan department of your neighborhood bank. Because it happens regularly, most applicants are terrified that their credit score may prevent them from being accepted. You should not fear, though, as lenders’ loan method does not rely on credit. You cannot be denied because of a low credit score.

- Cash for Any Purpose. Many banks and credit unions have strict guidelines regarding loans. If you don’t specify the loan’s objective, the majority of these lenders won’t even issue you a loan. However, lenders believe that this is your private matter, thus they won’t ever inquire as to why you need a loan. Loan providers don’t mind whether you use your cash to pay high interest credit card bills, pay your utility bill, or just to get by. You can use the borrowed money however you like.

- Credit Ratings. Hard queries are often made by the majority of auto and mortgage lenders, which immediately decreases your score by a few points. You don’t have to be concerned about a hard inquiry further harming your credit score at the major credit agencies because they don’t pull credit scores at all.

- Adaptable Repayment Schedules. Car Title Loan helping the customers find flexible repayment schedules that work with their budgets is our main focus. You can pick from a variety of programs, but if one doesn’t fit your specific financial needs, lenders can easily construct one specifically for you.

What’s the procedure for making an inquiry for an online title loan with no credit check?

There is no need for a difficult application process for online title loans with no credit check! Actually, Title Loans may provide borrowers with a rapid approval process that is renowned for being speedy and effective.

You can anticipate the following during the inquiry process:

- Send a loan inquiry. You can do this online or by calling a representative. If you are qualified, just respond to a few inquiries regarding your car and income to continue the inquiry process!

- Sending a few documents will assist a loan agent decide whether you are eligible for cash. You can do this by email or fax.

- Once you’ve been approved for an online title loan, the following step is to decide how to obtain your money and sign the loan contract. Appropriate borrowers can opt to pick up their money from a participating money-transfer outlet close by. In addition, they have the option of receiving a check in the mail or a direct transfer into their account.

Car Title Loans Online for Bad Credit

A loan might not be available to you if your credit is poor. Online title loans with no credit check are still a possibility, though. This is because the lender is less concerned about your credit history because the loan is secured by your car. Your credit score range is used by lenders to assess your reliability as a borrower. In order to simplify things look through the table below to find out what credit score is considered to be good or bad.

| Credit Number | Range | Percentage of the US Citizens having this credit rating |

| 800-850 | Excellent | 20% |

| 740-799 | Very Good | 25% |

| 670-739 | Good | 21% |

| 580-669 | Fair | 18% |

| 300-579 | Poor | 16% |

In general, borrowers with bad credit or those who require immediate cash may find that online title loans without credit checks are a perfect option. Make sure to search around and compare lenders if you believe this type of loan is suited for you in order to get the best rate and conditions!

Also, take into account nearby businesses that provide services that allow you to begin the application totally online. This implies that you may manage the paperwork and processing from your home, check the vehicle, and sign the loan agreement all on the same day. The nicest aspect of this is that you could be able to pick up your money from the lender within a few hours!

If you need money right away, online title loans with no store visit or credit check can be beneficial. You can get the money considerably faster than if you had filed for an installment loan through a bank, which can take up to a week, thanks to some online title lenders that can accept and finance loans within 24 hours!

Conclusion

If you’re searching for car title loans but are worried about your credit score, don’t be! Our no credit check title loans can get you the money you need without affecting your credit.

With our no credit check title loans, your car is your credit. That means that as long as you have equity in your vehicle, we can help you get the money you need–fast, easy, and with no credit checks!

Payday Loan Calculator

$500 Your loan + $79 Your fee = $579 Total Cost*

* Total Cost - The sum of money you are to pay off within the term you’ve chosen if you borrow the stated above amount for the average (or required by your lender) APR.